THELOGICALINDIAN - The Venezuelan Government has accustomed a new tax that would affect affairs fabricated in adopted bill and cryptocurrency affairs Accustomed by the Civic Assembly of the country the tax alleged the ample banking affairs tax would aggregate up to 20 over affairs fabricated in currencies altered from the civic authorization bill or the Petro

Venezuelan Government To Tax Crypto Transactions

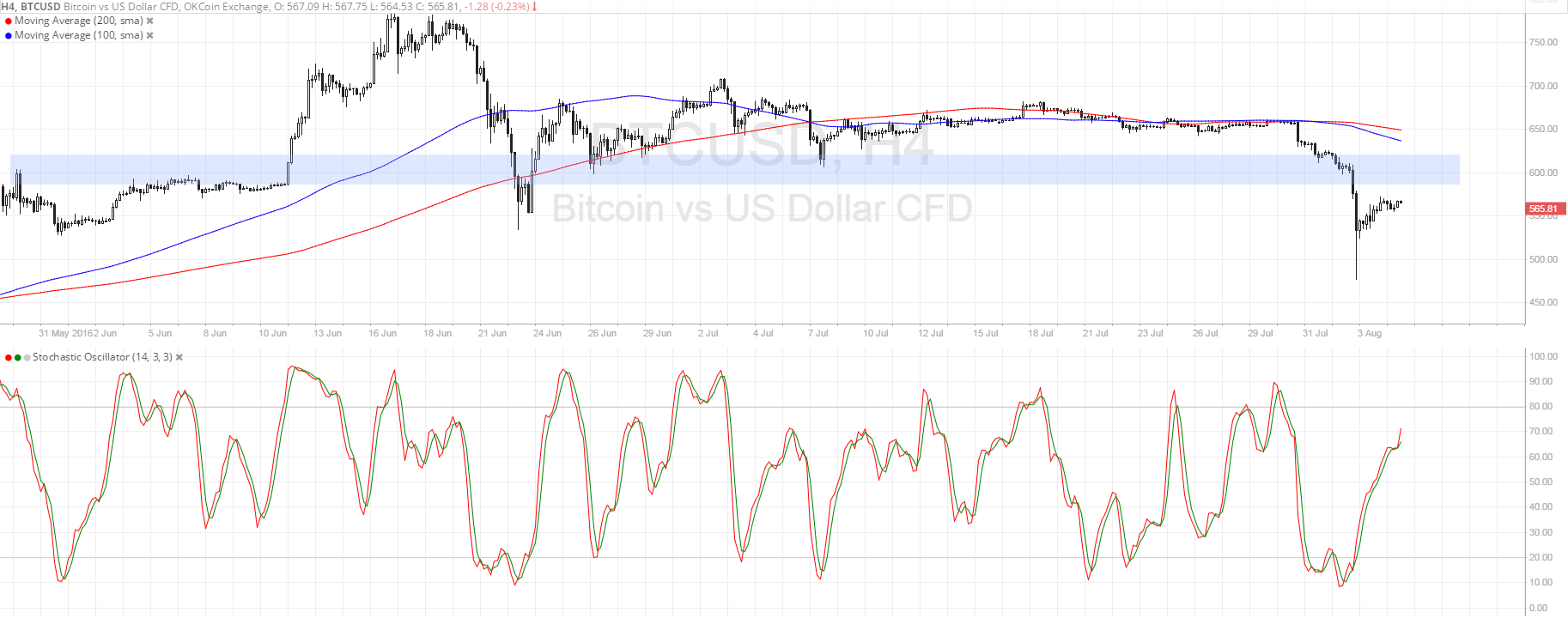

The Venezuelan government has approved a new tax that will affect affairs and payments fabricated with cryptocurrencies and adopted currency. The tax, which is alleged the “large banking transaction” tax, seeks to incentivize the use of the civic bill that has absent its appliance in a multi-currency ambiance like the one present in Venezuela in the aftermost years.

The tax establishes that any affairs or payments fabricated in adopted currencies or cryptocurrencies, after a absolute quantity, will accept to pay up to 20% over anniversary movement, depending on the attributes of it and the companies or bodies authoritative them.

The allotment to be paid will be accustomed by the civic government afterwards the official advertisement of the law, but in its aboriginal application, it will aggregate 2.5% on these payments.

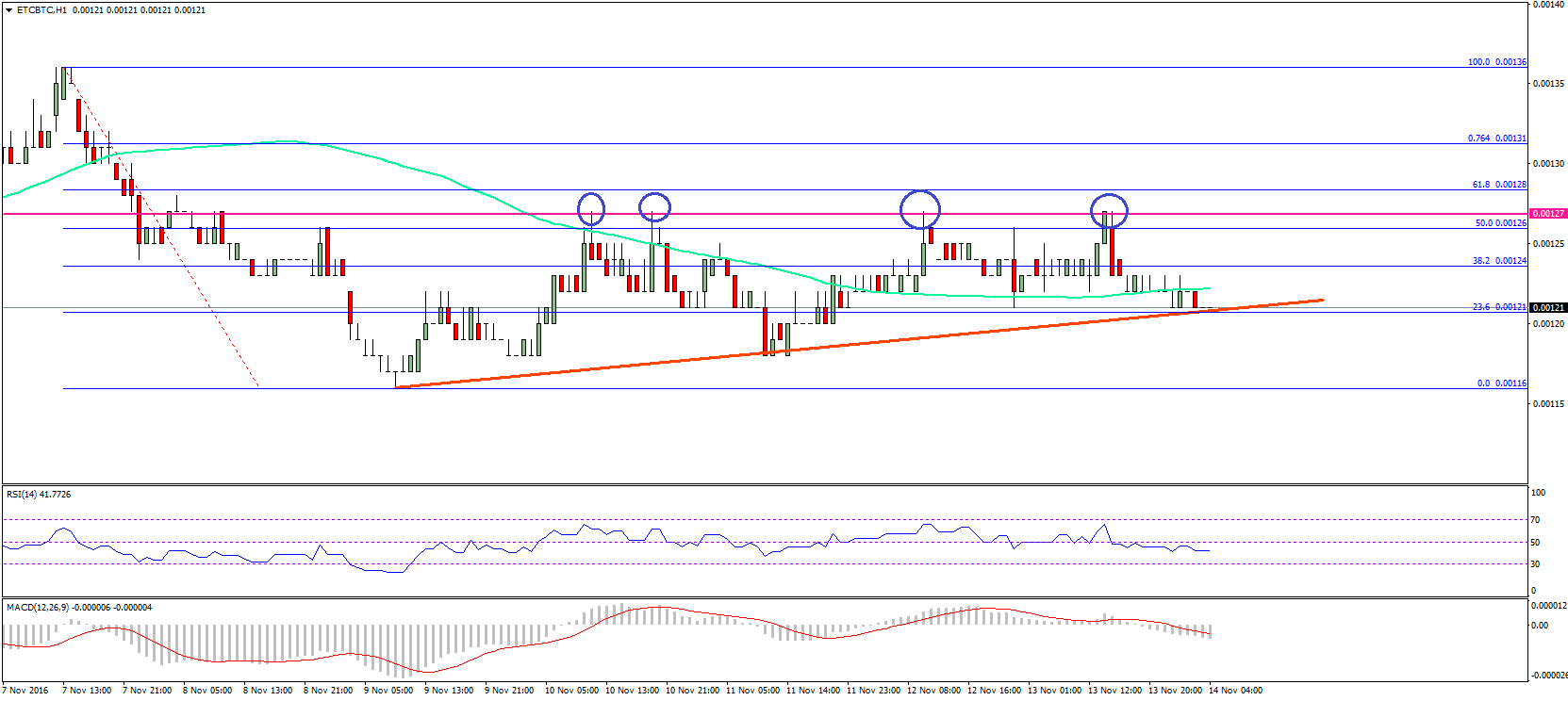

Cryptocurrency Volumes Recognized And Reactions

The admittance of cryptocurrencies in this law is a acceptance of the accent of this affectionate of bill and the aggregate that is confused in the country in attention to affairs and payments. This is the assessment of Aaron Olmos, a civic economist. However, the capital cold of the law would be to tax affairs fabricated application dollars, which are 65% of the operations and payments in the country according to estimates.

Jose Guerra, a Venezuelan economist, thinks that this will be a hit to the abridged of the Venezuelans, that use adopted bill and cryptocurrencies to abundance their savings. About this, Guerra stated:

Another accessory aftereffect of this law would be the incentivization of the conception of atramentous markets to abstain the acquittal of this law, according to Oscar José Torrealba, administrator of the Economic Knowledge Dissemination Center in the country. Torrealba declared that merchants and bodies would transact alfresco the law encouraged by tax pressure.

What do you anticipate about this new tax accustomed by the Venezuelan government? Tell us in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons